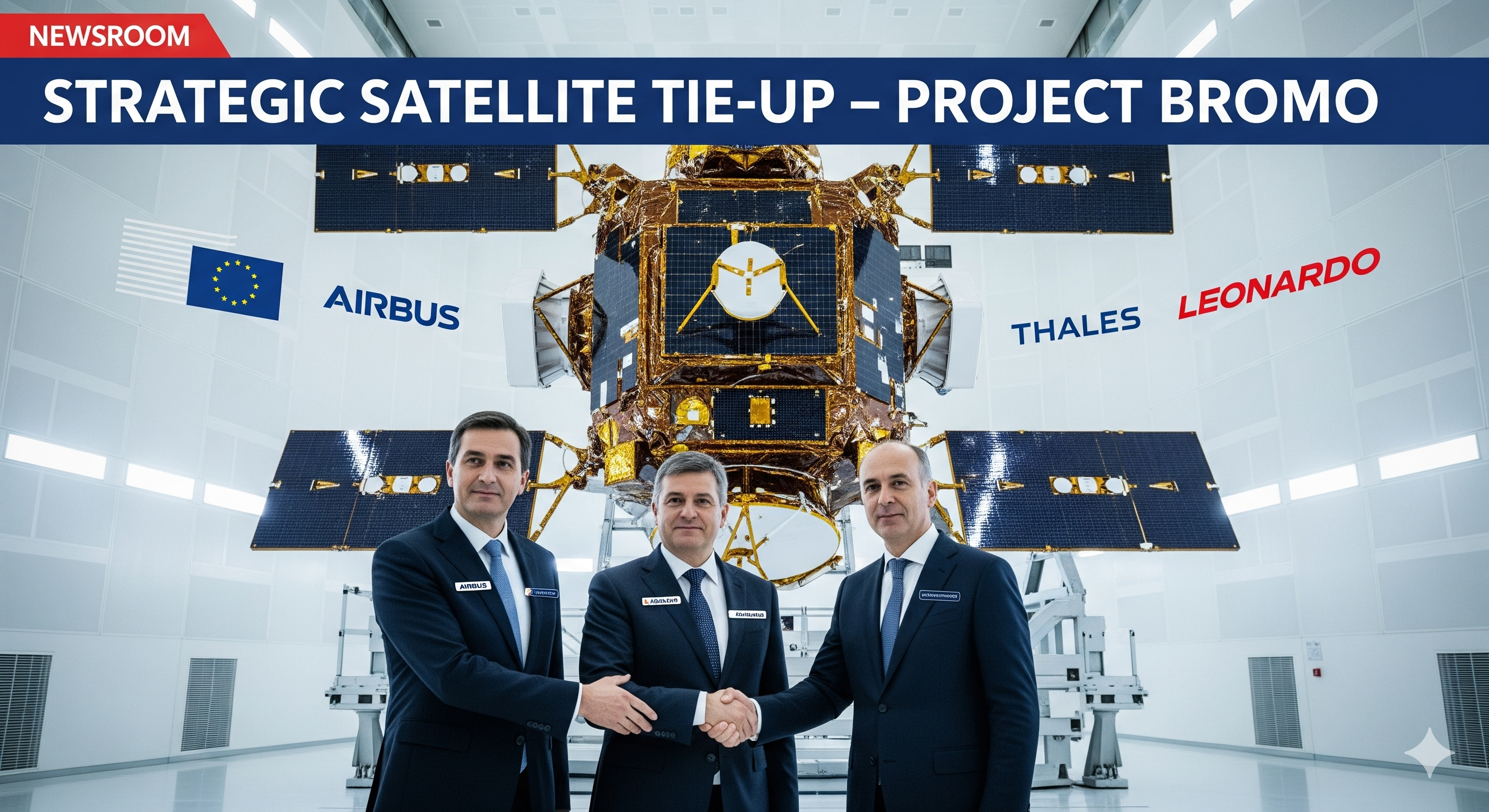

New Delhi, September 15, 2025 – A new satellite tie-up between Airbus, Thales, and Leonardo is progressing steadily under Project Bromo. The initiative aims to consolidate the firms’ satellite manufacturing efforts into a single, unified venture. As a result, Europe could gain a more competitive position in the global satellite market.

Project Bromo intends to challenge dominant players from China and the United States. In particular, the joint effort will offer competition to systems like Starlink. Additionally, the project reflects growing concern over Europe’s reliance on foreign space technologies.

Michael Schoellhorn, Airbus Defence and Space CEO, confirmed progress in an interview with Italy’s Il Corriere della Sera. He noted that a framework agreement might be signed before the end of 2025. Therefore, the deal would serve as the first step toward establishing the new venture.

He outlined a two-phase approach. First, the companies will agree on the framework. Then, a closing phase will finalize operational and legal details. Schoellhorn remains optimistic about completing the initial phase next year.

While financial terms have not been disclosed, the collaboration aims to pool infrastructure, workforce, and intellectual property. Accordingly, the joint venture would benefit from a larger scale and shared development pipelines.

Each company brings specific strengths to the table. Airbus excels in platform development and launch systems. Thales contributes secure communication technology and specialized payloads. Meanwhile, Leonardo adds expertise in high-grade manufacturing and defense solutions.

Moreover, the satellite tie-up supports long-standing European policy goals. Policymakers have urged the aerospace sector to reduce fragmentation. A stronger collective presence may allow Europe to remain competitive against non-European giants.

This move comes at a critical time. Satellite demand continues to rise, driven by data services, environmental observation, and military surveillance. Furthermore, Starlink’s rapid deployment has placed added pressure on older, fragmented production models.

The European space industry has faced slow growth due to limited funding, complex regulations, and innovation delays. Therefore, combining efforts under one venture could resolve many of these long-standing issues.

Shared research and development could lower costs and improve design cycles. In turn, this would allow customers to access more efficient and customized satellite systems. Shorter timelines and reduced overhead would offer additional advantages.

However, several strategic matters still require resolution. Governance models, intellectual property sharing, and access to global markets are all under discussion. Schoellhorn emphasized the importance of resolving these details before moving forward.

European regulators are also reviewing the potential deal. Approval from competition authorities remains crucial. To succeed, the companies must demonstrate that the satellite tie-up will promote, not hinder, innovation.

If completed, the joint venture could set a new precedent. Other European firms may follow suit, particularly in propulsion, avionics, and cyber-related fields. Future partnerships may emerge based on the outcome of Project Bromo.

The announcement has already attracted attention from across the aerospace ecosystem. Stakeholders including investors, suppliers, and governments are closely monitoring the deal. Clearly, the project has become a focal point for Europe’s space ambitions.

Rising geopolitical tensions have added urgency to such ventures. Governments are investing heavily in space infrastructure to protect sovereignty and strengthen defense capabilities. As a result, satellite development now holds strategic national importance.

Airbus, Thales, and Leonardo are well-versed in joint programs. Their prior partnerships may offer valuable experience in managing complex international collaborations. This history could prove essential in delivering Project Bromo successfully.

Besides strategic benefits, the tie-up may help advance Europe’s digital and environmental agendas. Satellites are essential for broadband access, climate tracking, and disaster monitoring. Thus, a stronger European manufacturer could speed up progress in these fields.

Despite remaining hurdles, the effort continues to build momentum. All three firms appear committed to alignment. Ultimately, this satellite tie-up may help redefine Europe’s influence in the rapidly evolving space industry.

As Schoellhorn concluded, “We’re on the right track.” The coming months will determine if this ambitious vision can be realized.