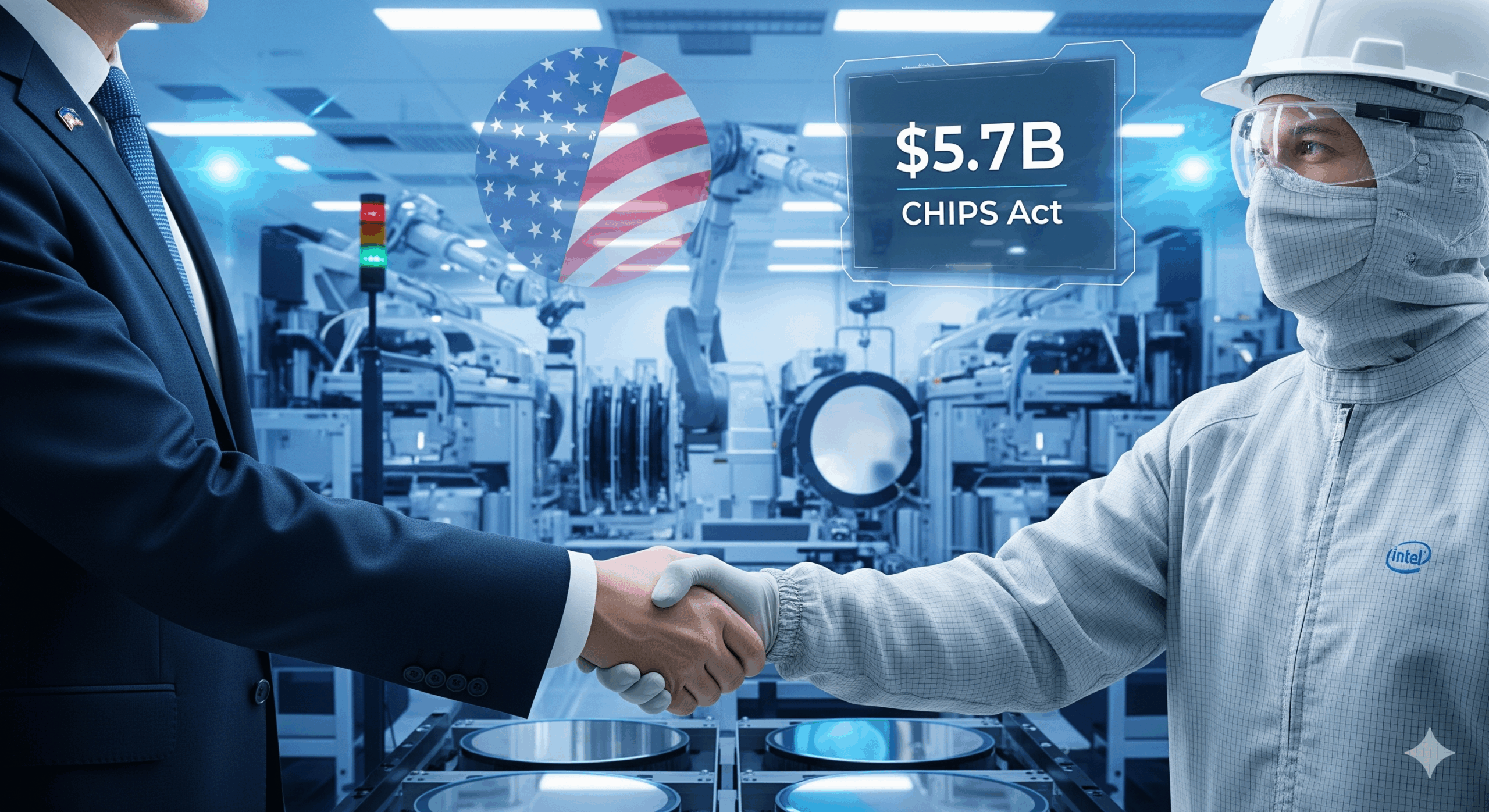

New Delhi, India, 02-September — Intel has secured early access to $5.7 billion in government funding under the CHIPS Act. The U.S. Department of Commerce approved an updated agreement, giving Intel more freedom to speed up its semiconductor manufacturing efforts.

Initially, Intel was required to meet a series of conditions before accessing the funds. The original agreement, signed in November 2024, outlined project milestones that acted as release triggers. However, the revised deal eliminates those conditions. As a result, Intel can now use the money immediately to advance infrastructure and research initiatives.

Even so, the agreement includes firm limitations. Intel cannot spend the money on stock buybacks or shareholder dividends. In addition, the company cannot engage in foreign deals that affect control or expand operations in restricted regions. These limitations aim to support U.S.-based production and protect national interests.

Under the new terms, Intel issued 274.6 million shares to the federal government. Furthermore, the government may purchase an additional 240.5 million shares, depending on certain criteria. Intel also placed 158.7 million shares in escrow. The company will release these shares once the government provides further funding for the Secure Enclave program, which focuses on high-security chip technologies.

So far, Intel has invested $7.87 billion in CHIPS Act–eligible projects. These include upgrading plants, purchasing equipment, and funding R&D. With the latest installment, the U.S. government’s total commitment to Intel rises to $11.1 billion. That figure includes $8.9 billion in equity and $2.2 billion in prior grants.

The U.S. taking a 9.9% equity stake in Intel signals a new approach to industrial policy. Moreover, President Donald Trump has indicated that similar investments could follow. This shift suggests a growing strategy of direct support for essential industries.

Intel’s CFO, David Zinsner, stated that the government’s stake reinforces the company’s focus on its foundry division. This business segment produces chips for other firms and is central to Intel’s future growth. By keeping control of the foundry, Intel aims to better compete with TSMC in Taiwan and Samsung in South Korea.

At the same time, the timing of this deal is highly strategic. The U.S. continues to reduce its reliance on overseas semiconductor manufacturers. The COVID-19 pandemic and global tensions exposed weak spots in the supply chain. Consequently, domestic production has become a national priority.

Intel’s partnership with the government plays a critical role in this broader effort. Specifically, the funding will support the construction of new fabrication plants and the expansion of existing ones in the U.S. Additionally, it will accelerate innovation in sectors like defense, AI, and healthcare.

The CHIPS Act aims to encourage private investment in American chipmaking. To ensure accountability, the law also includes guidelines on how federal money is spent. Intel’s revised deal reflects this dual purpose; it offers flexibility while maintaining federal oversight.

This type of arrangement could become a model for future collaborations. As competition grows in the semiconductor sector, other tech companies may follow Intel’s lead. Likewise, the government could increase its role in tech investment through equity-based funding.

Intel reaffirmed its plans to grow U.S. manufacturing. The company will use the new capital to accelerate construction, increase R&D, and boost chip output. In Intel’s view, the revised deal confirms the government’s confidence in its leadership role in advanced technology.

Ultimately, partnerships like this may shape the future of global semiconductor production. They help stabilize supply chains, promote innovation, and serve national priorities. Intel’s latest deal under the CHIPS Act could become a roadmap for public-private collaboration in the tech space.