Hey, have you ever thought about how technology might revolutionize the way we perceive insurance? Well, it’s already underway, and IoT in insurance is the key to it all. Sounds thrilling, right? Let’s get into how IoT is turning insurance more intelligent, quicker, and more personalized, one device at a time.

The Insurance Tech Revolution: The Role of IoT

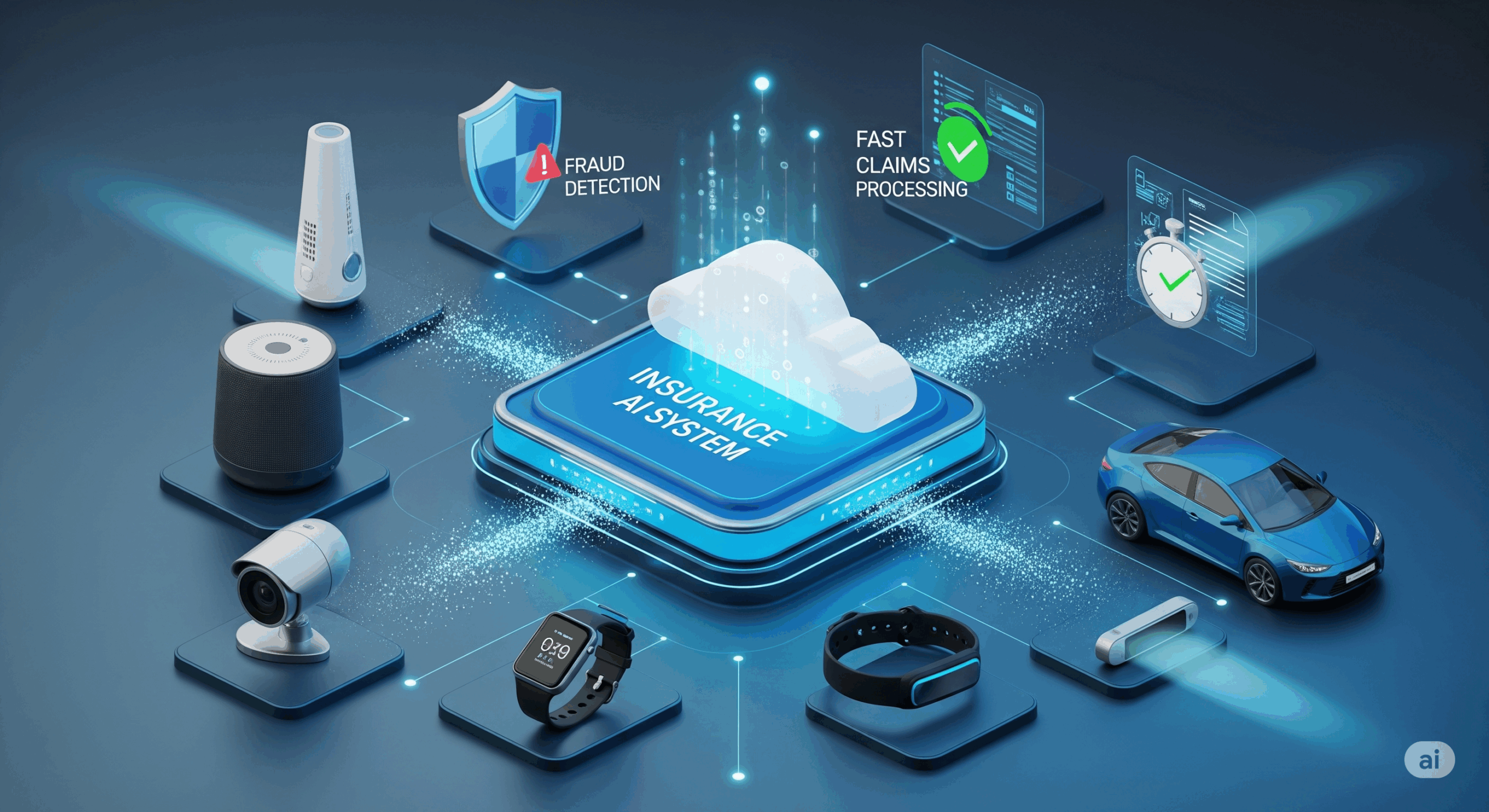

Insurance has been around for ages, but let’s face it, it hasn’t always been the most tech-savvy industry. But all that’s changing, due to IoT in insurance. Insurers increasingly use data from devices like smartwatches, fitness trackers, and connected cars to personalize and reshape policies. This tech is enabling insurance companies to predict risks more accurately, create personalized plans, and even speed up claims processing.

As more and more devices get on the network, IoT in insurance is no longer about selling insurance; it’s about making it personal. Whether it’s a sensor inside your car tracking your driving habits or a device at home that can detect leaks before they occur, IoT allows insurers to know your risks in real-time and offer better customized protection. It’s insurance that knows you, as opposed to the mass-produced kind of the past.

How Are Insurers Using IoT?

This is where IoT comes into its own in the insurance industry. Insurers are now able to utilize data generated by IoT devices to measure risk better. For instance, vehicle telematics monitors your driving style, giving good drivers reduced premiums. Smart home devices can also sense smoke or water leaks, enabling insurers to identify issues before they become expensive claims.

The best thing? These devices also prevent losses, which means less need for claims to begin with. Consider this: you might have a connected home that could warn you of a fire before it becomes a real problem, or a connected car that could signal potential danger, ensuring you’re a safer driver. The outcome is fewer claims for insurers, which could mean lower premiums for you. It’s a win-win!

Major Players Defining the Future of IoT in Insurance

Technology’s biggest players are coming to the fore to assist insurers in monetizing IoT in insurance. Wipro, Cognizant, and IBM are a few companies that are in the driver’s seat, with solutions that enable insurers to incorporate real-time data and enhance decision-making.

Capgemini and Microsoft are players too, developing platforms that enable insurers to link all their information into one simple system to keep track of. And don’t forget Intel and Telit, whose hardware and IoT connectivity solutions enable insurers to collect and analyze data better.

These technology moguls are revolutionizing the business by creating sophisticated analytics and cloud-based systems that enable insurers to make better, speedier decisions. It’s all about leveraging IoT in insurance to automate processes and enhance efficiency.

Why Does IoT in Insurance Matter?

You might ask, “How does this help me, the consumer?” Let me tell you: IoT in insurance is making your insurance experience more streamlined and personalized. Here’s why:

1. Personalized Coverage: Because of the data gathered from IoT devices, insurers can offer more personalized policies. For example, if your vehicle is equipped with a safe-driving device, you might be eligible for a discount. Or, if you wear a fitness tracker, your health insurance could decrease depending on your activity. It’s insurance that adjusts to fit your way of life.

2. Better Risk Assessment: With IoT insurance, businesses can track real-time information to determine risks more effectively. Whether it is the temperature of a home or monitoring one’s driving behavior, the information provided to insurers enables them to offer improved coverage at a more affordable price.

3. Fraud Prevention: Fraudulent claims are a major issue in insurance, but IoT in insurance helps reduce fraud. For instance, IoT devices installed in cars can capture all the details of an accident, which facilitates a speedy and equitable resolution of claims.

4. Accelerated Claims Settlement: Perhaps the most awesome aspect of IoT insurance is how it accelerates claims settlement. Insurers have real-time information at hand, so they can make quicker judgments on claims, shaving off minutes and hours and making customers happier.

The Future of IoT in Insurance: What’s Next?

In the future, the scope of IoT in insurance is tremendous. The IoT insurances market is projected by experts to rise at a compound annual growth rate (CAGR) of 11.1% between 2025 and 2031. This implies that insurers will be investing more in IoT technology, resulting in even more customized policies and quicker services.

In the coming years, we can expect to see even more sophisticated applications of IoT in insurance. Your home, for instance, will be able to sense when there is a fire or water leak and alert your insurer in real-time. Your car will offer even more detailed driving information, and insurers will be able to provide you with real-time prices and rebates based on the way you drive. The possibilities are simply endless.

Conclusion: Why IoT in Insurance Is a Big Deal for You

Well, the use of IoT in insurance is personalizing policies, making them more affordable and accessible. From connected devices that can track your health or your driving habits, IoT in insurance is changing the face of the industry. Insurers such as Wipro, Capgemini, and Microsoft are spearheading this change, and insurance is becoming smarter, quicker, and more efficient.

The insurance future is now, and it’s all about networked devices, real-time information, and more tailored coverage. Next time you consider insurance, recall: it’s not about having a policy, it’s about having an insurance plan that works for you. Cool?