Synopsys Chip Design Tools

New Delhi, India, December 11- Synopsys reported fourth-quarter results that beat analyst expectations, fueled by rising Synopsys chip design tools demand across global markets. The company posted revenue of $2.26 billion, slightly above estimates of $2.25 billion, and adjusted earnings of $2.90 per share, surpassing forecasts of $2.78. Investors welcomed the news, pushing shares up nearly 5% in extended trading.

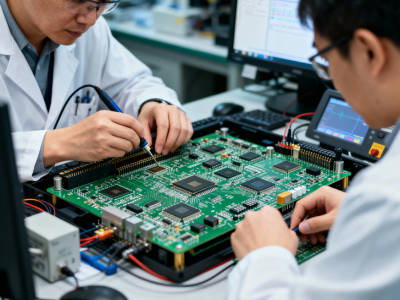

The surge in Synopsys chip design tools demand reflects a broader trend in the semiconductor industry. As artificial intelligence and advanced computing gain momentum, chipmakers need sophisticated design solutions to handle complex architectures. Synopsys has positioned itself as a leader in this space, offering tools that enable faster and more efficient chip development.

The company’s acquisition of simulation software maker Ansys added significant value to its performance. Completed in July, the deal contributed $667.7 million to fourth-quarter revenue. Synopsys said this integration strengthens its ability to deliver system-level solutions, which are critical for next-generation chip design.

Partnerships with major technology firms have also played a key role. Collaborations with Nvidia, Intel, and Qualcomm are helping Synopsys develop advanced tools tailored for AI-driven products. Last week, Nvidia invested $2 billion in Synopsys as part of an expanded multi-year agreement. This partnership aims to create new design solutions for industries adopting AI at scale, further boosting Synopsys chip design tools demand.

Despite strong results, Synopsys is making strategic adjustments to stay competitive. The company announced plans to reduce its workforce by about 10%, a move intended to reinvest in high-growth areas such as AI-powered design and integrated system solutions. This decision reflects a broader industry trend where companies prioritize innovation while managing costs effectively.

Looking ahead, Synopsys expects first-quarter revenue to range between $2.36 billion and $2.42 billion, compared with analyst estimates of $2.38 billion. This guidance signals continued momentum as Synopsys chip design tools demand remains strong. The electronic design automation market is projected to grow rapidly as chipmakers accelerate efforts to build processors for AI and high-performance computing.

Competition in this space is intense, with rivals like Cadence Design Systems and Siemens vying for market share. However, Synopsys’ recent acquisitions and strategic partnerships give it a clear advantage. The company combines design and simulation capabilities to provide comprehensive solutions for modern chip development challenges.

The company’s performance highlights a critical shift in the semiconductor industry. As AI adoption expands, chip design becomes more complex and resource-intensive. Tools that enable faster, more efficient design processes are now essential for innovation. Synopsys chip design tools demand illustrates how vital these solutions have become for technology leaders worldwide.

For investors, Synopsys’ strong quarter and optimistic outlook signal confidence in its long-term strategy. The company’s focus on AI-driven design, system-level solutions, and partnerships with industry giants suggests that growth opportunities remain significant. With demand for advanced chips showing no signs of slowing, Synopsys appears well-prepared to capitalize on this trend.

Moreover, Synopsys is actively exploring new technologies to maintain its leadership position. In addition, the company plans to expand its AI-driven design portfolio while strengthening collaborations with global chipmakers. Furthermore, analysts believe these steps will not only sustain Synopsys chip design tools demand but also set new benchmarks for innovation in the semiconductor industry. As a result, as computing needs evolve, Synopsys is expected to remain a key enabler of progress, thereby driving efficiency and performance for next-generation chips. Overall, these initiatives highlight the company’s commitment to staying at the forefront of technological advancement.